is the interest i paid on my car loan tax deductible

What would my loan payments be. In general you can deduct interest paid on money you borrow to invest although there are restrictions on how much you can deduct and which investments actually qualify you for the deduction.

How Does Car Loan Interest Work Bmo

Interest paid on personal loans is not tax deductible.

. As you might already know. You cant deduct as interest on a student loan any interest paid by your employer after March 27 2000 and before January 1 2026 under an educational assistance program. If you claim a business deduction for work-related education and you drive your car to and from school the amount you can deduct for miles driven from January 1 2021.

Deductible car fees go on the line for state and local personal property taxes Note that your state might not specifically refer to the fee as a personal property tax. For example if you have a first mortgage that is 300000 and a home equity loan thats 200000 all the interest paid on both of those loans may be deductible since you didnt exceed the. Interest effectively raises the price of the things you buy whether its a new home a car or equipment for your business.

How much self-employment tax will I pay. In some cases those interest costs are tax-deductiblewhich is one more reason not to ignore them. Federal income tax estimator.

Interest paid on a loan to purchase a car for. The federal tax code includes a number of incentives to encourage investment. Homeowners who bought houses after Dec.

The interest you pay on your auto loan is not. The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 1 million of mortgage debt. Should I adjust my payroll withholdings.

Capital gains and losses tax estimator. You can claim a tax deduction for the interest on the first 750000 of your mortgage 375000 if married filing separately. In other words 103042 in interest has already been paid in the loans first 20 years 123312 - 20270 representing 83 of the total interest over the life of the loan.

In other cases interest is simply the price you pay for using someone elses money. The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. Therefore this can make paying off the auto loan more appealing since youll want your mortgage loan to last longer.

A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property. Again this benefit will vary from house to house. Interest incurred to produce rents or royalties this may be limited.

A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral. Farm business interest. Types of interest not deductible include personal interest such as.

The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. Among them is the deduction for investment interest expenses. Before raising your deductible keep in mind that if you raise your deductible your out-of-pocket expenses would be higher if you were.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. See Publication 527 Residential Rental Property and Publication 535. If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does not reduce your tax.

A mortgage calculator can help you determine how much interest you paid each month last year. Nevertheless if the fee is value-based and assessed on a yearly basis the IRS considers it a deductible personal property tax. What is my potential estate tax liability.

See Publication 225 Farmers Tax Guide and Publication 535. HELOCs are no longer eligible for the deduction unless the proceeds are used to buy build or substantially improve a home. 15 2017 can deduct interest on the.

Will my investment interest be deductible. Compare taxable tax-deferred and tax-free growth. Mortgage interest on your primary home is tax deductible for those people who itemize.

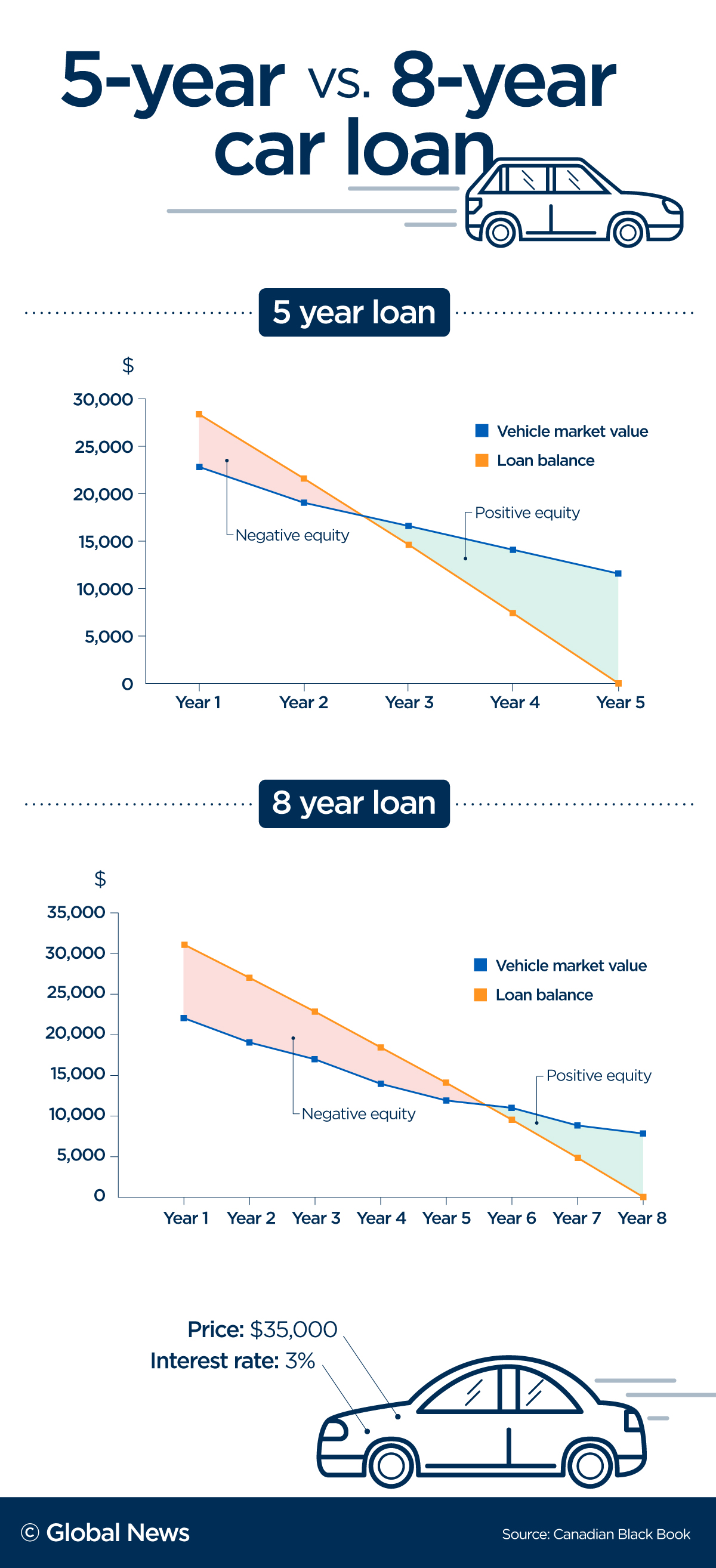

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits Idfc First Bank

Car Loan Payment Deferrals Loans Canada

Car Loan Calculator Estimate Your Car Payments

Is Car Loan Interest Tax Deductible In Canada

How Much Cash Should You Put Down On Your Next Car Loans Canada

Financing A Car What You Need To Know Credit Com

Quickstudy Finance Laminated Reference Guide Small Business Tax Tax Prep Checklist Tax Prep

10 Brilliant Budget Trackers For Your Bullet Journal Bullet Journal Budget Money Makeover Bullet Journal

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Car Loan Tax Benefits On Car Loan How To Claim Youtube

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage Interest Mortgage Interest Property Tax Tax Deductions

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Car Loan Tax Benefits And How To Claim It

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)